15 Dec 2011

Development of agriculture in Russia and its impact on fertilizer use

S. Ivanova, V. Nosov

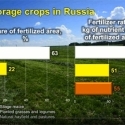

After 1990 the fertilizer consumption declined from almost 11 million t of nutrients (1990) to current 1,9 million t. And in spite of the slight increase during the last 5 years it hardly reaches 15% of the level in 1990. There are many reasons responsible for that fall. First of all the share of fertilized area shrunk in two ways. In 2007 it amounts to only 35% of the total sown area in spite of the positive trend during the last 5 years. Secondly the fertilizer application rates for almost all crops decreased substantially. The most significant fall was for sugar beet, flax, sunflower and fodder crops. Because of the very large area involved (42 million ha) , the reduction in fertilizer rates on fodder crops accounts for about 40% of the total fall in fertilizer consumption. As a result an average application rate has been reduced from 88 (1990) to 32,4 kg (2007) of nutrients per ha.

The current nutrient balance in arable soils of Russia is negative for all nutrient with a deficit of 22 kg of N, 6.2 of P and 22.6 of K for every ha.

The main fertilizer use constraints in Russia can be summarized as follows: structure of agriculture and the lack of small and medium size enterprises, reduction of livestock numbers, low-gate prices for commodity agricultural products, inadequate use of modern agricultural production, undeveloped fertilizer distribution system, and slow recovery of advisory and soil analysis system.

Despite these constraints there are emerging opportunities to increases fertilizer consumption in Russia. Starting from 2007 the government realizes incentives aimed to stimulate crop production. First of all the government initiated a national program on agriculture development which is working to revive agricultural production in Russia. The program focused on animal husbandry, stimulation of private farm production up to 30% of agricultural output through subsidies for bank interests, establishment of farm’s cooperatives, land mortgages, and house building for young agricultural specialists. It is projected that realization of the program will result in significant increase in production index for both crop production and husbandry. With all this going on the production index for crops production should reach 124% over 1990 by 2012. It is estimated by the Russian Ministry of Agriculture that due to realization of the program the demand for mineral fertilizers will be increased to 4,5- 6 million t to 2012.

In spite the globe financial crisis there is a positive trend in fertilizer application for this year. To the end of March 2009 734 thousand tones of mineral fertilizers (in nutrients) have been already bought by agricultural enterprises that is 61 200 tones more than in the same period of 2008. Taking into account the fertilizer reserves from 2008 the total amount of mineral fertilizers for application during this spring is about 994 400 tones that is on 181 900 tones (in nutrient) more over the same period in 2008. This amount is equal to 56 % of mineral fertilizer demand estimated by the Russian Ministry of Agriculture.

Secondly the government implemented guaranteed minimal price for such cereals as wheat, barley, rye and maize. If market price falls below this fixed minimal price the government starts buying the excess of grain at a minimal price. For 2009 the minimal price for wheat is fixed at the level USD 145-180 per ton depending on protein content in grain.

The government abolished income tax for agricultural producers until the 1st of January of 2013 and VAT has been reduced to 10% (for the rest it is 17%). Government compensates producer’s rates for credit used to buy machinery, fertilizers and seeds and gives direct subsidies to compensate fertilizer cost.

And finally the government will support agricultural sector to survive during the globe financial crisis of 2008- 2009 giving additional subsidies for agricultural producers in amount of 30 billion USD.

IPNI has developed the AgriStats software projecting mineral fertilizer use by crop in more than 30 countries of the world. This software will soon be released to member companies of the institute. Actually, IPNI monitor medium- and long-term changes in agricultural statistics in AgriStats. So, we look into the future and estimate mineral fertilizer consumption based on possible developments of world agriculture after an economic crisis we are observing right now.

We assess crop yield potential and attainable crop yield, which is realistically possible under best management practices. Taking into consideration the available agriculture statistics in Russia, we use average fertilizer application rates in agricultural enterprises (excepting private farms) and with some degree of approximation extrapolate these data for the whole sector. For instance, Rosstat reports that 76% of area under wheat in 2008 was cultivated by agricultural enterprises. Projections of mineral fertilizer use by selected major crops in Russia have been recently finalized by our staff. The crop list includes wheat, grain and forage maize, sunflower, potato, sugar beet and annual and perennial grasses (tame hay).

The AgriStats software can calculate fertilizer consumption growth rate using past 10 years’ data. This approach is based on historical growth rate of crop acreage. The second approach, in contrast, uses staffestimated growth rates of cropping areas for long-term perspective.

AgriStats forecasts regarding mineral fertilizer application to wheat based on the second approach are discussed below. We estimate that wheat cropping area will increase to 27.2 M ha in 2018 and further to 30.9 M ha in 2027, assuming that Russia will be an important exporter of wheat grain in future. There are two general scenarios: intensive and extensive (Table 1). The intensive scenario takes into account mineral fertilizer rates required for attainable wheat yield, i.e. rates close to fertilizer best management practices. It is also prognoses that attainable fertilized area will reach 80% for nitrogen and 70% for both phosphorus and potassium. This attainable fertilized area is a realistic estimate of the potential area that could be expected to receive fertilizer nutrients.

The extensive scenario for wheat shows future estimates of nutrient consumption based on current fertilization practices and expectations for future harvested area, assuming that current application rates would not change and incentives for farmers to apply fertilizers remain constant.

In future IPNI will update the analysis every year, adding newly available information for a certain crop such as yield potential, attainable yield, attainable fertilizer rates and also area fertilized attainable. The expected crop acreage will be also revised based on agricultural developments in selected countries, including Russia.

During most of the 1990s, Russian agriculture experienced a dramatic loss of capital and all the key indicators of agricultural efficiency and productivity deteriorated. However after devaluation of the rubles in 1998 Russian agriculture, especially crop production has grown steadily, while important structural and organization changes have begun to emerge, particularly within the corporate-farm segment. In this new situation entrepreneurs appear interested in investments into agricultural production and are ready to pay for new machinery, fertilizers, quality seeds and professionals in order to get real profit due to production intensification. One of the most dramatic changes has been the emergence of large, and in most cases externally owned and managed, commercial farming operations so called agro-holdings. Agro-holdings form a production chain from crop production to processing/storage and sales. For example, owners of sugar processing plant invest in sugar beet production, owners of concentrated feed plant and chicken farms invest in cereals production. As a result production cost decreases while aggregate profitability increases. Currently in Russia there are two types of agro-holding – governmental and private. However, private holding demonstrates more profitability due to significant investments in enhancement of production. Agro-holdings dominate in cereals, sugar beet and sunflower production.

One of the most expected results of agriculture expansion in Russia for world food market is significant increase of cereals export. From 105,5 M metric tons (t) of cereal output in 2008, Russia could increase grain output up to 125 M t simply by enhancing yield management and bringing fallow land back into production. According to estimates made by the Ministry of Economic Development due to realization of potential to boost cereal production, Russia will be able to increase export from current 16 Mt to 22-35 Mt of cereals. These changes will help restore supply and demand imbalances across key cereal markets. To realize the potential to boost production of cereals Russia should put into practice the innovative scenario of crop production development including renovation of agricultural machinery and implementation of intensive production technologies instead of extensive technologies widespread nowadays. It is estimated that due to shift to intensive technologies NPK application rate per one hectare of cereals will increase from current 32,4 kg (2007) of nutrients to 39 kg in 2010 and 110-117 kg to 2020.

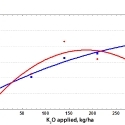

And at the end we would like to give you an example of IPNI estimations of yeild loss due to potash fertilizer applications less than optimal for both spring and winter wheat in Russia. We used maximum agronomic efficiency of fertilizer K for wheat summarized from field experiments conducted in Russia. Undoubtedly, a long-term soil potassium mining is observed in Russia due to very low use of potash fertilizers. According to our calculations, the weighted average of wheat yield increase due to potash fertilizer use is equal to 0.2 t ha-1 and 0.13 t ha-1 for winter and spring wheat accordingly. Taking into account both winter and spring wheat acreage, i.e. 12.7 и 13.9 million ha (M ha) in 2008, respectively, yield loss from potash non-application amounts to 2.54 and 1.81 million metric tons (M t) for winter and spring wheat, respectively. The total assessment of yield loss for wheat crop is, hence, equal to 4.35 M t. It is important to note that high quality grain is mainly lost because potassium is a “quality nutrient” for crop production. Potassium is important for grain protein formation in wheat. Better milling and baking qualities of wheat grain are obtained with potassium.